iTrustCapital Review - Cheapest Crypto IRA of 2022

- By Zachary Greene

- |

- Updated on December 26th, 2022

iTrustCapital is without a doubt our #1 pick for Crypto IRAs, as they provide low-cost IRAs that are not only easy but low-cost and with a great interface. They also allow investing in physical Gold/Silver and in our opinion are the best for that as well — making them a great IRA account for folks worried about inflation or the general economic environment over the long-term.

| 💰 Fees & Pricing | Lowest Available |

| 💻 Ease of Use | Very Easy |

| 🛠 Customer Service | Above-Average |

| 🥇 Best Feature | Staking Service |

With that being said I won’t bury the lead — iTrustCapital while best for crypto and gold/silver IRAs in our opinion they aren’t nessecary the best overall depending on what you’re looking for in an IRA account.

They don’t allow you to invest in anything but Gold/Silver and Crypto, so if you want to invest in equities/stocks or other assets they’re not really the best choice — at least in isolation, you can always have multiple IRA accounts with different IRA providers, such as one with iTrustCapital and one with TdAmeritrade.

With that being said if you want a more ‘all-in-one’ IRA we’d recommend checking out our review of AltoIRA as well, as they provide alternative investment options including Crypto + Gold options at similar fees — they’re just a bit less user-friendly in our experience.

Table of Contents

iTrustCapital Unique Features:

iTrustCapital is one of the only platforms like it — however it’s not the ONLY one like it, there’s also AltoIRA which we’d say is worth considering — these two are the best services for investing in alternative assets and crypto in tax-advantaged IRA-style accounts.

Below you’ll find some unique features to iTrustCapital, as well as some noteable ones that both of the platforms have which we think are important and unique that make them stand out as the #1 and #2 platforms in the industry.

Fantastic Metals (Gold/Silver) Integration

Most IRA accounts do not allow you to own physical metals outside of an ETF/Fund structure that charges annual storage fees, and have many other storage-related concerns (such as the Bar ZJ6752 Concern) — well iTrustCapital allows you to buy physical Gold/Silver with no annual storage fees with the custodian being Kitco, the largest precious metals and commodity news outlet and gold coin seller, where you’ll be allocated a portion of their vaults storage in the form of coins/bars/etc.

This has many advantages in our opinion — namely avoided ‘paper gold’ fears and annual fees, but also you benefit from Kitco Pricing, which is on-par with physical gold, rather than ‘etf gold’ or ‘paper gold’ meaning in times of uncertainty gold with Kitco generally goes up higher in price and trades at a premium relative to other gold, as while you may not be able to get delivery when it’s owned through an IRA account like iTrustcapital it still trades at Kitco Prices — meaning if gold is trading at a premium at Kitco they’ll let you sell it to them at a premium, as they can turn it around and sell it to other people who physically want gold coins right-away for a premium immediately after they gain ownership over it again.

Super ‘Clean’ Interface

iTrustCapital has, without a doubt, the best interface of any of the crypto/gold/silver IRAs we’ve used, with the exception of BitcoinIRA — however BitcoinIRA charges multiple times what iTrustCapital and others charge in commissions/fees, so we don’t really consider them as worth considering for most folks.

To elaborate, with iTrustCapital the interface just works — it doesn’t have any glitches or complexity like other platforms — it’s simple like how Coinbase used to be, with just a simple buy/sell button, your portfolio holdings, and a few extra tabs for your settings and beneficiary information.

Very Low & Reasonable Fees

While we’ll cover the fees in specifics later-on this is one of the big features iTrustCapital has that’s better than the competition — they have the lowest fees in the industry with no ongoing management fees of any assets held within their IRAs but also the lowest trading fees of any platform we’ve seen when it comes to cryptocurrency, coming in at only 1% per trade — the only other IRA that matches this pricing is AltoIRA.

As already mentioned regarding their gold/silver investment options they’re also very low, particularly long-term due to a lack of storage fees, and currently is in our opinion the best place to get a Gold/silver IRA account.

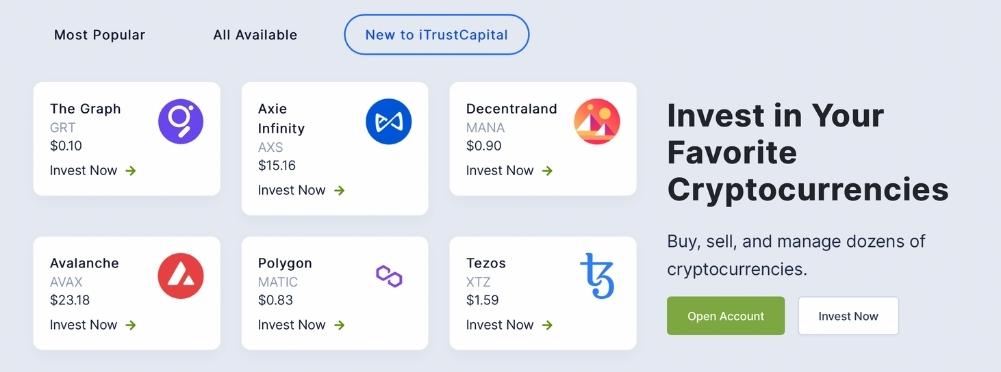

Plenty of Crypto-Investment Options

While we’re not big fans of most altcoins we are big fans of choice — and iTrustCapital gives you the choice to invest in pretty much any mid to large-cap cryptoasset, so long as it’s somewhat legitimate and offered by their liquidity provider they’ll let you invest in it through your IRA — currently this amounts to 25+ separate crypto assets and projects.

Cryptocurrency Staking

iTrustCapital is the only crypto IRA or tax-advantaged account generally that allows you to stake digital assets and receive yield on them currently — keep in mind this is done through opt-in and is not automatically done when you buy stakeable cryptocurrencies in iTrustcapital.

With their crypto staking service you don’t need to do anything beyond opt-in as they have partnerships with staking providers which provide the service for a portion of the reward — however you still get the majority of the staking yield — so it’s a good deal.

iTrustCapital Biggest Pros & Cons:

While we’ve mentioned some features and benefits (pros) of iTrustCapital we didn’t cover them all — nor have we touched on the cons, so we’ll go over them briefly now starting with the Pros of iTrustCapital:

- Highly Regulated & Transparent

- Best-in-Class Crypto & Gold/Silver Interface

- Lowest Fees for Gold/Silver and Crypto IRAs

- Allows Non-Accredited Investors (anybody)

- Allows SEP IRAs and ROTH IRAs as well as traditional IRAs

- Can Easily Roll IRAs from other provides to iTrustCapital

However there are some cons compared to other platforms, such as iTrustCapital:

- Lacks Traditional Equity or Alternative Investment Options

- Doesn’t Support 401ks, only for IRAs

- Customer Service isn’t particularly great unless you call them

As for 401ks, as described here it’s very difficult to open a 401k account on your own or with alternative investments, and in the case of iTrustCapital it’s not supported at all — however no crypto-401ks currently exist so that’s sort of to be expected.

Lastly the final real con of iTrustCapital is their support, in our experience, is a bit ‘sub-par’ compared to other platforms unless you call them — if you call their support is great, but if you email/submit-a-ticket it can take days to get a reply. Hopefully they improve their text/email support, as many folks don’t like calling for support.

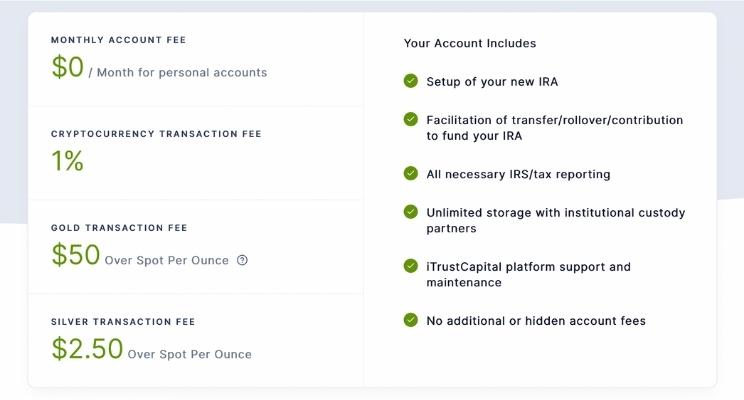

iTrustCapital Pricing for Average Users:

iTrustCapital’s Pricing is relatively straightforward as outlined above — the charge 1% of every crypto trade you make in your IRA, $50 per ounce of gold you buy, and $2.50 for every ounce of silver you buy — the crypto fee is the lowest in the industry only matched by one competitor — AltoIRA — and the gold/silver fees, while high on the surface, include indefinite storage fees and do not have annual fees, storage fees, or any other fees beyond the transaction fee, which makes it exceptionally low in the long-term, and more secure than most Gold ETFs in our opinion.

Beyond those there aren’t really any fees to iTrustCapital, there’s a few minor account closure and wire transfer fees that are standard across all platforms, generally around $50 to $100 for every platform, and ultimately do not effect most people — the only other fee not mentioned above that’s relevant to most people is potentially a conversion fee of $75 if you want to convert a traditional IRA to a SEP IRA or Roth IRA with iTrustCapital, which is again relatively industry-standard.

For average users, verses a traditional IRA account, you’ll pay significantly less with iTrustCapital when investing in crypto/gold/silver over the long-term, as well as get better assets — for example with crypto to buy it in regular IRA accounts generally you have to buy a fund that owns bitcoin or futures contracts of bitcoin and pay 3% per YEAR + a transaction fee, while with iTrustCapital it’s just a flat 1% each time you trade with no ongoing fee.

iTrustCapital vs Competitors:

There’s only one real competitor to iTrustCapital in our view — and that’s AltoIRA, which offers a wide range of alternative assets, including art, real estate, hedge funds, wine, startups, etc, as well as low-cost cryptocurrency and gold/commodity investing in an IRA. There’s a few other crypto-IRAs like BitcoinIRA, but they have higher fees with no real benefit vs AltoIRA, which is why really the decision in our mind is between AltoIRA and iTrustCapital.

To be direct if you want a more polished platform for investing in crypto (or gold/silver) via an IRA then iTrustCapital has a better interface and is more user-friendly, however if you want to invest in other alternative assets as well, with the same fees, then AltoIRA would be a better choice — you can read our review of AltoIRA here, but essentially it just allows you to invest in more assets, but is a bit more complicated to use, but otherwise is otherwise comparable to iTrustCapital.

Do note with AltoIRA if you invest in non-crypto assets they charge a $10 monthly fee (for most users), however for their crypto-only product there’s no monthly fee, but rather just the same 1% buy/sell fee iTrustCapital Charges for crypto. This is why we say they’re only better if you want to invest in other alternative assets now or in the near future — as to have access to those features they charge you more due to the regulatory requirements such accounts require.

Our Experience With iTrustCapital & Conclusion:

There’s not really much to say about our experience with iTrustCapital if we’re being honest — the platform just works, it’s simple, and they do what they say how they say it and that’s about it — we have no complaints, but there’s also nothing particular we feel the need to rave about — iTrustCapital is our #1 pick if you just want to invest in gold/silver and crypto in your IRA, as it has the cheapest pricing in the industry, alongside competitor AltoIRA, but with a much more polished interface and generally is just more pleasant to use.

If you want to invest in other alternative assets such as art, wine, eREITs, or other non-publicly traded assets (startups for example) then you’d probably prefer to go with AltoIRA as they support those + have crypto support, all in an IRA and for the same/similar fees to iTrustCapital — however if you aren’t immediately into investing in such things, or have a small IRA account that’s just being funded, then iTrustCapital is a great place to start with or use exclusively in it’s own right.

iTrustCapital Review FAQ's:

Below we’ll go over the FAQ’s we’ve been asked, or encountered, or even had asked ourselves about iTrustCapital when we first were checking them out and as we used them — If you have other questions feel free to contact us and we’ll get back to you as soon as we can — and likely even add our answer down below.

How are taxes handled with iTrustCapital?

iTrustCapital being an IRA provider is responsible for all the tax filing nonsense hassle — they handle the paperwork and all you’ll need to do is submit a form they give you and/or mark your contributions on your tax paperwork — a few minute process — no burdensome paperwork is added just because you use an Alternative Investing IRA vs traditional IRA account.

Is iTrustCapital Trustworthy & Legitimate?

There’s no history of fraud or untrustworthy behavior with iTrustCapital or it’s management, and being a well-known IRA company with around 100 employees we’d argue they’re trustworthy — especially considering they do not have access to your assets at all, as they aren’t the custodians of the crypto or gold you buy — but rather they simply deal with the legal/tax paperwork and interface for you, while assets are held with seperate custodians (namely coinbase and Kitco).

Is iTrustCapital Insured?

While there’s many types of Insurance you may be wondering about iTrustCapital has just about all of them — they have insurance against employee/management misconduct, they have protection against hacking, they keep cash deposits in government-backed (FDIC) insured accounts, and like most IRAs your investments are also protected in case they (iTrustCapital) goes bankrupt somehow.The only risk with iTrustCapital is making bad investments — alternative investments can be great, but some are terrible just like all investments. There’s no protection or insurance against bad decisions, so invest wisely — don’t just go all-in on some shitcoin you haven’t researched just because you heard it’s going to moon.

How Does iTrustCapital Make Money?

iTrustCapital hasn’t officially announced how they make money, and they aren’t a public company so it’s hard to know for sure, but judging by their pricing/fees and business model they likely just profit-share the trading fees with the custodians (coinbase and Kitco) and then make money by using cash balances to invest in US-treasuries that pay them a small (risk-free and insured) yield.

Who owns iTrustCapital?

iTrustCapital is owned by Todd Southwick, who is also the CEO of iTrustCapital, and Blake Skadron, the co-founder and CVO of iTrustCapital — they run the company and own it along with many investors which invested in their series A round in 2022. iTrustcapital is still a private company, meaning it’s not publicly traded or investable to average folks quite yet — you’ll have to work at the company or have connections to the founders to be able to realistically invest in them currently.

How long has iTrustCapital been in Business?

iTrustCapital was started during the bear market of 2018, however didn’t open up for investing until 2019~ when they officially started accepting clients for their tax-advantaged IRA accounts. Initially they started out with just a few offerings, but since then they’ve expanded to allow 25+ cryptos to be bought through the IRA accounts they offer, as well as gold and silver.

Our overall iTrustCapital rating

4.3

Bottom Line:

iTrustCapital is our #1 pick for tax-advantaged crypto IRA accounts due to them offering quality crypto projects to invest in, staking services, and overall the lowest fees and best experience in the industry.