Masterworks Review 2022 - Art Investing Made Easy

- By Zachary Greene

- |

- Updated on September 19th, 2022

Masterworks is without a doubt our #1 choice when it comes to investing in the art market — not only do they make it exceptionally easy to enter the art market, but they take the majority of the hassle out of investing in the art market.

While investing in alternative assets generally takes quite a bit of effort Masterworks makes it more or less effortless — they curate the investment opportunities to only well-known quality artists that have historically provided good returns and allow fractional ownership of such pieces, making them investable for average folks and not just the elite. They take care of storage and all that — and of course charge a small fee (covered below) for that service, but we believe it’s more than worth it.

| 💰 Fees & Pricing | Slightly Expensive |

| 💵 Overall Return | Above-Average |

| 💻 Platform | Simple & Easy to Navigate |

| 🥇 Best For | Portfolio Diversifcation |

With that being said, while we invest in art and believe Masterworks to be the easiest, simplest, and best way to gain exposure to the art market currently I feel that it’s important to say that investing in art is in fact an alternative investment, and while alternative investments are great they carry some cavuats.

Alternative investments like art shouldn’t compose the majority of someone’s portfolio for reasons we covered in our guide to investing in alternative assets, but essentially alternative assets often lack liquidity and have other issues that make them better as a diversification tool as someone’s wealth grows rather than the foundation they base their portfolio out of — so while Masterworks is great I’m not going to put 50% of my portfolio in the art market through them. 5% to 20% is more than enough for any alternative investment, including art.

Having said that below we’ll go over why Masterworks is the best platform and way to invest in art currently in our opinion — to not bury the lead they have low fees, are super easy to use, have good offerings to invest in, and historically have performed well compared to traditional investments.

Table of Contents

Masterworks Unique Features:

Masterworks is already extremely unique — it’s basically the only painless and easy way to invest in the art market. There’s no platform quite like it — there’s many platforms for investing in real estate online, there’s many platforms for investing in wine online, but there’s only one platform for investing in art online that is actually useable and functional for average investors — and that platform is Masterworks.

Direct Ownership of Art

You may find it strange we’re starting with this as a feature — but to us it is a feature and the most important one at that!

There’s no other way to directly own art than to buy an entire piece of art yourself — which for pieces from well-known artists generally costs thousands of dollars — and then you have the hassle of storing the art yourself or finding a warehouse to do so for you, which is not easy if you only have a few pieces of artwork. There’s some ways to gain exposure in non-direct forms, however if the company goes bankrupt the art is taken in the bankruptcy — this is not the case with Masterworks.

With Masterworks you actually own the art and have rights to it — along with all the other investors, meaning if masterworks ever goes bankrupt there’s no risk to your investment — you’ll get the proceeds from the auctions or be able to continue holding the investment regardless of what happens with Masterworks it’s self.

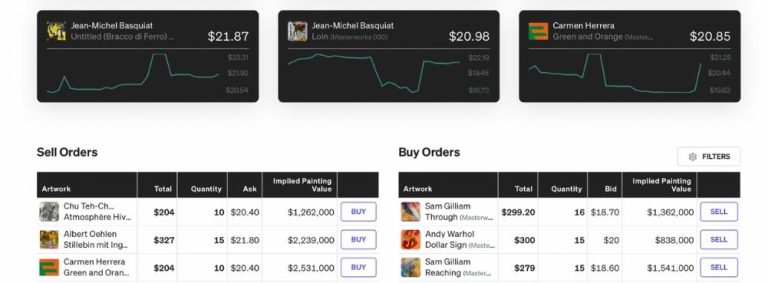

Excellent Secondary Market (Liquidity!)

This is the 2nd most important feature in our opinion — and one that’s only possible with Masterworks currently.

While generally in the art market investments are illiquid and not only have to be sold in their entirety (not fractionally) but have to physically be transferred to the buyer after the sale, not to mentioned listed on a marketplace with high fees, be certified as real before listing, and many other complications, with Masterworks as they handle the storage of the art and have this secondary market you don’t have to deal with any of those hassles.

Instead you can list the art you bought/invested in, or the fractions, on the marketplace for absolutely no fees and generally be matched with a buyer (assuming you price the piece at market rates) within days — sometimes less. This takes away the largest burdon of investing in alternative assets like art — as normally your funds are trapped in the asset class for years — but with masterworks within a few days you can generally get your investment cashed out.

Tax-advantaged Account Support (IRA)

While most IRAs will not allow you to invest in Masterworks through them there are a few that have partnered with masterworks to allow folks to invest via certain retirement accounts — our favorite one for this is AltoIRA which offers not only IRAs that allow you to invest in masterworks, but most other alternative assets such as fine wine (through Vinovest or Vint), cryptocurrency, sports memorabilia, start up companies, private equity, and pretty much anything else that’s ‘investable.’

Good Due Diligence & Investment Thesis Reports

Masterworks provides ‘Deal Sheets’ that explains the investment thesis and history of the artist in the offering, their pieces historic returns, and why they believe the piece on offer is a good investment opportunity.

Let me be clear — this isn’t going to satisfy you if you’re an art enthusiast, as the reports are relatively simple — however they provide more than enough information for commoners who simply want to have an idea on what they’re investing in and don’t care about every little historic detail of the artist, their art, why they’re producing such art, and why people are fans of it — investors just want a brief overview, and that’s what masterworks provides.

If you want further details you can discuss it with Masterworks, as they do due diligence to a high degree before agreeing to list an offering and have art experts on their team to make sure they are providing quality offerings for investors.

Allows Investors From (Almost) Any Country

While on the surface you’d think this is only relevant for them — international investors — this is a huge benefit for everyone who uses the platform as it allows MUCH greater liquidity in the secondary market as international investors from Europe and around the world also can use the platform.

Of course for international investors this is a huge benefit, most alternative assets are difficult to invest in as non-US investors, especially if they’re from a developing country or smaller country that struggles to get access to capital markets and investment opportunities. The only countries that are restricted from using Masterworks seems to be countries under international sanctions (North Korea, Iran, Russia, a few African countries, etc).

Masterworks Biggest Pros & Cons:

Masterworks is very unique and feature-rich as we’ve covered above, but there are also some other pros that are not feature-oriented to the platform, so we thought to make a quick bullet list to give you a summary of all the pros to masterworks:

- Easiest Way to Gain Exposure to the Art Market

- Allows Investors from (nearly) Every Country to Invest on the Platform

- Supports investing via certain tax-advantaged IRA accounts

- Provides concise Investment Thesis for every offering

- Securitized providing direct ownership of the art you invest in

- Offers a fee-free secondary market allowing cashing out early and trading of art

- Fantastic Track Record (Historic performance) albeit with short history

- Allows non-accredited Investors

- Low overall fees that are more than fair in our opinion

- Completely hands-off and managed once invested

- Fully insured in the event of artwork storage/damage issues

With those pros being aired out it’s time to mention the cons of Masterworks — which do exist unfortunately:

- Requires Phone-call or Zoom interview (takes 15-30 minutes) before allowing investment

- Doesn’t offer noteable sign-up bonuses or rewards for new users

- Doesn’t give exposure to new prints or lower-cost art releases, only higher-end single-copy artworks

- Long Investment time horizons (secondary market largely fixes this now)

To explain the cons a bit more — when signing up to Masterworks you have to sign up through an existing users link to ‘be invited’ as Masterworks likes to create false exclusivity in the platform — once you’ve done that and answered some basic questions they’ll want you to schedule a phone interview (or zoom interview) where they just reaffirm your investment goals and ensure you understand the investment class and have reasonable expectations.

Beyond that the only real downside is you don’t get exposure to smaller artists or the art print market, and that’s simply due to the pricing of such pieces being drastically less — often only a few hundred to few thousand dollars each. This is a shame as such prints can often go up multiple times in just a few years, but I suppose it makes sense as they’re not unreasonable for folks to buy on their own from reputable sites.

The secondary market largely solves the long time horizon, which masterworks says is generally around 7-10 years for each offering/investment they release, but as there’s a secondary market you can, in practice, sell anytime for a reasonable price if you have a little patience.

Masterworks Pricing & Fees:

Masterworks has a dual pricing scheme where they charge a low 1.5% fee per year to pay for storage fees and insurance, and then a 20% profit-only fee on the successful liquidation of the art to pay for the sourcing + securitization fees, as well as of course make the Masterworks company some money their self.

This is a very good pricing structure for investors as it aligns the incentives with the investment provider (Masterworks) exceptionally well — as Masterworks won’t really make money if they don’t provide you with quality art pieces to invest in, and if they provide bad investments not only will their profit go down but they could lose money on an offering (theoretically).

Overall paying 1.5% per year is an absolute steal all things considered, and while the 20% (profit-only) fee is a bit high ultimately it aligns incentives fantastically and isn’t all that bad when you understand the art market more — often times auction houses take 10% of the sale of art pieces, which is likely around 20% of your profits on a piece, so realistically it’s not that bad or high relative to the general art market — albeit the fees in the art market are generally quite high.

Masterworks Expected & Historic Returns:

When you check the Masterworks website for what the historic returns they’ve gotten this is what they show — an outlandish few hand selected pieces they sold early as they had a huge return that beat the art market quite drastically. This is NOT what you should expect — 30%+ IRR is not normal in art, and not normal on the masterworks platform from what we’ve seen or experienced.

The expected return I’d say should be around the general (contemporary/high-value) art market return, which is around 10% to 14% annually over the last 20-something years — as after all that’s all Masterworks is investing in — high value (mostly) contemporary artworks.

With that being said this historic return of masterworks since inception has been around 14% (after fees/expenses), however this is only over the last few years — and this was during an exceptionally inflationary period which likely made the return a bit higher than it otherwise would be — we’d estimate that the return in the future, the actual expected return of masterworks investments, is likely around 11% to 12% after fees/expenses in normal conditions.

Our Experience Using Masterworks:

We started using masterworks in 2020 so we have quite a bit of experience with it — and overall it’s been a good experience. We’ve had a bit higher return than the average masterworks apparently has had across all their offerings (14.3%) coming in at around 16% for us, however ultimately this is nothing more than luck and standard deviation — we picked artists that we heard of before more than those we didn’t, and they went up more than others — nice, but likely not repeatable.

We never had any issues with the company itself or operations therein and can simply say their support/consumer-oriented investment folks seem competent and very knowledgeable about the art market, at least compared to non-art experts like us.

When using the secondary market — which we have used many times — we’ve had good times for finding buyers of the art we were trying to sell, and we had been able to pick up outstanding deals buying art on the secondary market that, presumably, people needed to get rid of quickly. After such experiences we primarily invest through the secondary market, as often times people underprice what they’re trying to sell, not being patient.

In our experience selling via the secondary market only takes a few days if selling at-market, and never more than a couple weeks, but of course your experience may be different if market-conditions are different at the time.

Closing Thoughts & Conclusions

Masterworks is our personal favorite and #1 choice for investing in art — but that’s not saying much as they’re the only really accessible option for average investors.

With that being said, while Masterworks has been a good investment for us and has returned higher than the S&P 500 for example we still aren’t going to be allocating a large amount of our portfolio to the art industry or Masterworks — as not only it’s an alternative asset and while we love alternative investments and have much of, even most, our portfolio in them we don’t keep the majority in any one alternative investment. Diversification is key when investing, and having multiple sources of income, from many different types of investments, is what takes the stress away from investments and makes you not only become rich, but feel wealthy.

We’d also like to caution potential investors regarding masterworks, or rather the art market in general — while it’s a good investment class in our opinion and one we invest in, we feel the need to stress that the art market is heavily propped up by tax-avoidance schemes and is an extreme luxury good — if tax policies change globally, especially in the USA, regarding art and tax write-offs the art market could potentially experience major declines — especially if the economy and luxury goods market is in a bad position. We’d say this is unlikely, however it’s important to be aware of the possibility before making investments in the industry.

Masterworks Review FAQ's:

Below we’ll go over the FAQ’s we’ve been asked, or encountered, or even had asked ourselves about Masterworks when we first were checking them out and as we used them — If you have other questions feel free to contact us and we’ll get back to you as soon as we can — and likely even add our answer down below.

Is Masterworks a Good Investment?

Using Masterworks in our experience has been a good investment for us as it’s returned quite well over the last few years — better than the broader art market has historically, and overall we’re satisfied with our investment in the sector through Masterworks. It’s not our highest returning investment, but it’s a nice investment that returned above average returned and helped diversify our portfolios away from more risky volatile investments.

Does Masterworks Provide Insurance?

Masterworks provides insurance built-in to the annual management fees on the platform — you’ll have no trouble collecting insurance benefits if their storage facilities are damaged, destroyed, or seized for any reason as the wines belong to you and are insured for you and cannot be seized in the case of bankruptcy (on the part of Masterworks) or other issues. Non-invested funds with Masterworks are also insured with FDIC insurance automatically, so you don’t need to worry about it either -- well for Americans they're held in an FDIC insured account, for international investors it's unclear.

Does Masterworks offer any sign-up bonuses or rewards?

As far as we’re aware of Masterworks does not offer any sign-up bonuses or rewards for new users — they do however have a partner program that allows websites like this one to earn a small savings on platform fees or in some cases compensation if people sign up through their special partner links. You can use ours by clicking here, doing so will support us and help us keep these articles up to date and accurate.

How long has Masterworks been around?

Masterworks started accepting clients in 2019 however didn't real gain substantial traction until 2020 when alternative investing really become something more people began considering important -- currently they have around 200 employees and partners, although not all of them are full-time from our understanding.

Is Masterworks (the company) Publicly Traded?

Currently Masterworks is not publicly traded and instead is entirely funded through private funding rounds and founder/employee contributions. They've completed a series A funding round via crunchbase, however are likely years away from going public or being acquired by a larger firm.

Our overall Masterworks rating

3.9

Bottom Line:

Masterworks is the best option for average folks to gain exposure to art, and there’s really nothing to complain about in terms of performance, platform functionality, etc — but the fees Masterworks charge, namely the 20% realized profit sharing fee, is a bit high and is one of the reasons we rated them lower than some other alternative investing platforms.

With that being said Masterworks historic return, and in our opinion their future return, will continue to outperform the broad markets, so it’s not a bad investment to invest with Masterworks — it’s just we feel other alternative investments, such as Wine, are a bit better in terms of risk-reward currently.

Alternative investments are primarily for diversification though — and masterworks accomplished that exceptionally well, so if you already have an established portfolio outside of the art market they’re a great choice to gain exposure to the art market, diversify, and reduce overall portfolio volatility and correlation.