Personal Capital Review - Our #1 Pick For Portfolio Tracking

- By Zachary Greene

- |

- Updated on December 12th, 2022

Personal Capital is our #1 Pick for Portfolio Tracking & Wealth Management as it has everything average folks need to keep a track of their portfolios, expenses, and money across various accounts — as well as of course track their networth — while being completely free to use.

To address the skeptics — YES personal capital is safe, it’s partnered with huge banks and is owned by one of the largest wealth management companies in the entire world — the reason it’s free to use despite being so feature-rich is because they will offer financial advisement services, which can you don’t need to accept, which can make them money over the long-term. They don’t need to charge for the dashboard as a result — it’s a lead magnet for them, not how they make money.

| 💰 Fees & Pricing | The Cheapest (Free) |

| 💻 Platform Features | Useful & Understandable |

| 🛠 Platform Integrations | Everything but Crypto |

| 🥇 Best Feature | Overall Financial Visualizations |

With that being said, Personal Capital is not the only wealth management site/app or portfolio tracker out there that’s worth considering — Kubera is also good, however they charge a small monthly fee which is why they’re our #2 pick rather than #1 pick like Personal Capital.

To not bury the lead we do actually think Kubera is better — however they charge for using the dashboard and tracking your networth and the only real advantage they have is that they support linking many cryptocurrency exchanges and lending platforms, while Personal Capital doesn’t — that’s their real advantage, and as you can simply enter in your crypto holdings manually (if you have any) on Personal Capital we don’t think that one real pro justifies the cost of Kubera.

Overall both are good choices but our personal choice and recommendation for average folks would be to sign up to personal capital. They aren’t pushy with their wealth-advisement and you can simply opt-out, but from what we’ve heard it’s not bad if it’s something you’re interested in, as the financial advisors they connect you with are fiduciary advisors, meaning they operate on a fee basis rather than a commission basis, and thus have your interests as their #1 priority.

Table of Contents

Personal Capital Unique Features:

Personal Capital is one of the only platforms like it — however it’s not the ONLY one like it, there’s also Kubera which we’d say is worth considering — these two are the best services for tracking your portfolio, networth, and generally keeping track of your financial situation in our opinion.

Below you’ll find some unique features to Personal Capital, as well as some noteable ones that both of the platforms have which we think are important and unique that make them stand out as the #1 and #2 platforms in the industry.

Painless Networth Tracking

While this may seem obvious to you — that personal capital, a platform meant to track your wealth, does a good job at it — but that’s not an easy task and something almost every other app or platform has failed at achieving. Personal Capital DID achieve this though — it’s completely painless to track your networth with them.

You don’t need to add anything manually other than cryptocurrency holdings held in private wallets or crypto-specific exchanges, or businesses you may own. Everything else will automatically be tracked and updated once you link the accounts — be it your credit cards, your bank account, your brokerage account, your retirement accounts, your savings accounts, your personal loan debts — basically anything is linkable.

The only things that aren’t auto-updated and tracked are crypto holdings (as mentioned above) and things that aren’t necessarily assets or easily priced — think your home or your vehicle. We’d recommend just updating these once every few months or year, or ignoring them entirely as they don’t represent ‘liquid-networth’ which is what really matters vs your overall networth.

You vs The Market Indexing (You Index)

This is one of my personal favorite features, and not just because I outperformed the market in the last yearly period — but rather because it makes it effortless to see how your trading or investing is stacking up compared to the market. If you’re underperforming the market over the long-term, or historically (you can use this feature to backtest your returns) then it makes it easy to see that, take a step back, and reevaluate if you should change your investing strategy.

For example in the above chart of my 1 year performance starting in early 2020 –– I was drastically outperforming the market, making a whopping 291.1% return, while the S&P 500 made had a return of 38.8%, which is fantastic and didn’t know how great I did in the covid-recovery period till I saw that — but as you can also see in the last few months of that one period my performance cratered and I gave back around half of my return in just a few months.

If losing a huge chunk of my portfolio wasn’t a wake-up call enough logging into personal capital and seeing me underperform the S&P 500 drastically in the last few months was another good kick in the face that I needed at the time to get myself back on track — I reassessed my positions and strategies, changed some things, decreased leverage, and have since fixed this drastic underperformance.

That’s the benefit of the YouIndex feature — you can easily compare yourself, your returns, your historic returns, your current returns, to various indexes and markets and see if you need to have a serious sit-down with yourself and change your strategy. That could look like just selling everything and going all-in on the indexes if you heavily underperformed over the long-term, or it could look like backing off the leverage like it did for me when I got a little carried away.

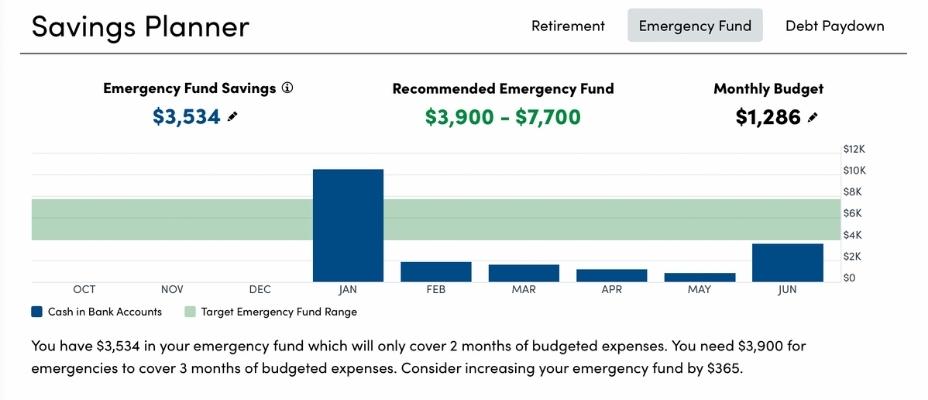

Emergency Fund Automatic Tracker

You might think ‘I don’t need an emergency fund’ or you may think ‘I already have an emergency fund why would this feature be useful at all?’

Well I thought the same thing and ignored it for the first year or two of using personal capital — however I’ve noticed something, two things in fact, the first was I was an idiot and didn’t have my primary bank account linked until earlier this year and thus am missing quite a bit of data for the emergency fund planner, the second more important thing I noticed is that the emergency fund is adaptive and can easily be adjusted to track your new monthly expenses and budget, giving you a more accurate target emergency fund.

Normally people plan an emergency fund and then forget to update it as their income and expenses grow, leaving them vulnerable to emergencies as while they used to only need $3000/mo to live they got a pay raise and are now spending $4000/mo, and thus while their emergency fund used to be $12000 (4 months) they now would be short an entire month of expenses if they don’t update their emergency fund target — well Personal Capital brings that to the forefront and makes it clear that you need to update it from time to time, as well as tracks it for you of course.

Cash Flow Analysis Feature

Similar to their Emergency Fund Tracker Personal Capital also has a cash-flow analysis feature that’ll check all your linked accounts for incoming vs outgoing funds and present you with a graph displaying how your cash-flow is looking — this is good to see how a pay raise or how inflation is effecting your expenses/cash-flow and can help you take notice to these changes right-away rather than weeks or months later after you’ve potentially been overspending for some time.

This is especially helpful if you have many credit cards and sources of income, as tracking all of that is a hassle without a tool like this.

Fantastic Retirement Savings Tracker

When you have your banking and investing accounts linked to Personal Capital you’ll be able to see how much more you need to save to be on track for the retirement goals you set when signing up — or of course if you’re ahead of your goal.

This takes the guess-work out of your retirement savings and planning, as you no longer have to worry about how much you’ve saved or invested this year and stick to a strict schedule every month of adding to retirement funds the same amount — instead you can invest/save whatever you happen to have extra in a month and have it counted effortlessly with Personal Capital.

It’s definitely not a must-have feature, but it’s something that saves a bit of time over and over that really adds up, and is an easy way to visualize your progress.

Personal Capital Biggest Pros & Cons:

While Personal Capital has plenty of great features we’ve covered above there are some others we think are worth mentioning, as well as some cons we’ll outline below that’ll be the key deciding factor on if you want to use personal capital or not in our opinion.

To start off, the pros of Personal Capital at a glace:

- Completely Free (for self-directed portfolio tracking)

- Helps Keep Your Emergency Fund Well-Funded

- Ensures You Keep Spending on-track

- Displays Your Overall Financial Progress

- Uncovers Investment Underperformance

- Helps you Stay on Track with Savings + Retirement

- Personal Capital will Market to You

- Personal Capital May Share non-specific marketing data with 3rd parties

- They do not seemlessly track all cryptocurrency investments

- Doesn’t work Well if based outside USA

That’s really all the cons we can think of with personal capital — to elaborate as personal capital provides this all for free they try to make money by marketing their advisement services to you as well as (maybe) selling limited marketing data to 3rd parties — think that you use their app, not your networth, meaning if you’re very concerned about privacy you may not want to use personal capital — however in our opinion it’s not a real issue as they aren’t sharing sensitive information.

They also, as mentioned before, do not track crypto investments very efficiently and thus you’ll have to manually enter your holdings — they’ll keep track of the pricing of those investments though once entered, it’s just they won’t auto-update your holdings when you trade or buy more cryptocurrency. You’d have to handle that.

Lastly Personal Capital isn’t very good if you live outside the USA or other Anglo-Countries — this is because they do not have partnerships with foreign banks in general or most foreign brokerage accounts. You could link your brokerage account if it’s through a company like interactive brokers, but smaller country-specific banks generally wouldn’t be able to be linked if they’re outside of the USA.

Personal Capital Fees & Hidden Costs:

Personal Capital’s portfolio and wealth tracking dashboard and all the above-mentioned features are 100% free to use — and that’s what 90%+ of people are going to be using — while only a fraction will be interested in the financial advisement services and advisor-directed portfolio management services that we talk more about below — for those they charge 0.49% to 0.89% per year in management fees.

There are no hidden fees or nonsense to worry about with Personal Capital — both in the case of their advisement services as well as their 100% free to use portfolio/networth tracking dashboard. They won’t lock you out after a month and demand a monthly fee or any such nonsense — it’s free to use, completely free, and that’s seemingly going to be forever with no restrictions whatsoever.

Personal Capital Advisors & Portfolio Management

Personal Capital has a financial advisement devision that can, well, set you up with a fiduciary financial advisor at a (relatively) low cost — coming out to around a 0.5% to 0.9% management fee per year. That may sound high if you’re used to investing in ETFs like SPY but that’s actually really really low, especially for a fiduciary advisor, which is legally required to act with your best interest in mind.

We haven’t personally used their financial advisement services, however family members have and they’ve given us an insight into how it works — essentially after you’ve scheduled your free call with them you meet with an advisor who discusses your goals and life situation a bit with you, after which the advisor will recommend some financial tips followed by their recommendations on what you should invest in based on your goals.

Ultimately it seemed like they generally recommended ETFs and on occasion some broad-market funds that have reasonable expense ratios, and generally are quite sensible in their recommendations — as fiduciary advisors they don’t make commissions from getting you to invest in particular assets so generally they seem to recommend quite good investments and don’t push ridiciulously high fee funds or other nonsense like many financial advisors do.

With that being said, while their advisement services seem good, we’d say they’re not needed if you know some about investing and some discipline to stick to it on your own, as you can easily invest in a handful of index funds and choice assets, just dollar-cost-averaging into them over time, and generally have a similar performance to what advisement services that are good (like Personal Capital) offer.

The main advantage to getting advisement is getting direction and if you’re quite wealthy saving taxes (due to specific strategies they’ll likely recommend) and simply not having the hassle of managing your own portfolio — you might take a small haircut in return to pay for the service, but it’ll generally make life easier, and with fiduciary advisors like personal capital offer you’ll likely come out ahead or equal to investing on your own if you spend the time-savings doing something else.

Personal Capital vs Competitors:

There’s only one real competitor to Personal Capital in our view — and that’s Kubera, which also offers a comprehensive portfolio tracking dashboard and general wealth management, goal setting, progressive tracking, dashboard for you to use that includes investment accounts as well as your debts, bank accounts, savings accounts, and other forms of assets such as your home value, etc.

To not bury the lead — Kubera is better if you invest and/or trade cryptocurrencies quite often or are staking/lending them out for interest and want those things tracked perfectly — however that feature is basically the only thing that stands out, and Kubera costs around $12/mo vs Personal Capital costing $0/mo.

Personal Capital vs Kubera

Our Experience Using Personal Capital:

We’ve been using Personal Capital for years and our experience has been fantastic — there’s a few downsides that we already covered above, but essentially are limited to them not having partnerships with cryptocurrency exchanges making tracking your crypto portfolio exactly a bit more challenging, particularly if you’re trading quite often, and well that’s about it — otherwise Personal Capital has been a pleasure to use.

We stopped trading cryptocurrencies and have adopted a more ‘buy and hold’ approach to the portion of our portfolio allocated to crypto, so this isn’t an issue to us, that they don’t have API access or partnerships with crypto exchanges.

We’ve never had any issues with the platform technical or otherwise — and I’ve been pleasantly surprised to not be harassed by Personal Capital — I’d think as the service is free they’d be shoving their wealth management services down my throat, but at most I’ll get a single easily closeable pop-up once every few logins, or an email once every couple months, reminding me that they’ll give me a free consultation. That’s it — not pushy at all, which I like.

Ultimately I can’t speak on our experience beyond that — as while we’ve used it for many years there’s not much to say — it does what it says it does and it does it well, and that’s about it. It tracks what you link, it updates them frequently, and it allows you to easily see your historic performance and financial situation.

What about with their wealth-management services?

We have no personal experience with their wealth-management services, as we have not signed up for their financial advisement, so we can’t speak on our experience using that portion of Personal Capital — as we haven’t used it.

For what it’s worth we do know some people who have used it and have said they were good, and had high praises of the advisors they were put in touch with that work with personal capital, and as we mentioned before they are all fiduciary advisors meaning they are required to operate in your best interest, which is exactly what you’d want if you do seek financial advisement, so we’d say they’re likely a good option to consider if you do want financial advisement.

Personal Capital Review FAQ's:

There’s quite a bit of only information you may have questions about that we didn’t cover above — so down here will be all the questions y’all sent and asked us about Personal Capital or we asked ourselves about them — if you have a question not mentioned below or simply aren’t sure if they’re right for you feel free to contact us and we’ll try our best to answer your question or point you to someone who can.

Does Personal Captial Sell Your Data?

While Personal Capital words their answer to this as if it's a no, in other areas they suggest they do share some data with 3rd parties, so it's not quite clear how this works -- however according to Personal Capital they do not share 'sensitive information' like your networth or any of your financial data, nor do they share (or even have access to) the passwords or usernames of linked accounts.If Personal Capital sells or shares anything it seems like it'd only be your email, your name, and that you have an account with them -- beyond this it doesn't seem like they could share or sell your data without getting into trouble based off the legalese they've stated on their website

Is Personal Capital Free or Does it Cost Money?

Personal Capital's base product that most people are interested in, their self-directed portfolio manager and networth tracker, are 100% free to use and have always been free to use, and from our understanding will always remain free to use. The only services or features that cost extra with personal capital is if you decide to hire one of their fiduciary financial advisors to consult you on your portfolio or manage it on your behalf.

Does Personal Capital Work With Any Bank?

No, personal capital only works with certain partnered banks, however they have partnerships with most US-based banks and large financial firms within the country. If you have a bank account in another country it's unlikely to be able to be linked and directly tracked using Personal Capital.Does Personal Capital use Plaid?

No they do not use Plaid to link your banking or investing accounts to their platform -- instead they use a service called Verisign which is similar to plaid, but a little bit more secure as the information never passes through the intermediary/facilitator (plaid or verisign) but instead directly to the partnered bank/institution.

Is Personal Capital Safe & Secure?

Personal Capital doesn't store or even get access to your linked accounts login details so you can trust linking your brokerage accounts and bank accounts to their system -- as it's 100% safe and secure.The way Personal Capital works is when you link an account you log in to your bank, or financial institution/brokerage, and then they confirm you want to grant read-only access to Personal Capital, allowing them to view certain aspects of your account. This doesn't give Personal Capital any of the login information nor does it allow them to spend, transfer, or otherwise touch your funds or information -- it simply allows them to ping your bank and get updated information that you permit them to pull from your checking/saving/investment accounts and credit cards. This makes linking accounts entirely safe with Personal Capital. For those curious ones of you out there, no they do not share the information from your linked accounts with 3rd parties, that information is considered sensitive and is not meant for anyone's eyes but yours and -- if you so choose -- your financial advisors eyes.

Does Personal Capital Track Crypto?

Personal Capital does track crypto to some degree, however not to the level that Kubera does -- it's adequate for long-term investors and holders, but if you are an active trader, shitcoin investor, and speculator in cryptocurrencies then you'd be better off with Kubera, or simply excluding crypto from your networth tracking with Personal Capital.To be clearer -- you can add your crypto holdings to Personal Capital manually, and they'll automatically update the price of those assets, but they won't auto-update your trades in your cryptocurrency wallets or accounts, nor update with any staking/lending rewards you receive.

Is Personal Capital a Fiduciary or a Robo Advisor?

Personal Capital isn't a robo advisor, but rather a tool to track and manage your portfolio -- a dashboard of sorts -- however they do offer financial consulting services that is done by fiduciary financial advisors, so if that's what you're looking for you can get that with Personal Capital. They use real human beings for their financial advisory services and aren't just using robo advisors -- they'll listen to your needs and customize your investment plan based on those needs and goals.Does Personal Capital Work Internationally?

Technically Personal Capital works internationally and in every country, however in practice they do not have partnerships with most global financial institutions, banks, brokerages, etc, and thus you generally cannot track your portfolio or networth if you're not based in the United States of America.

Is Personal Capital Worth it?

I'd argue Personal Capital is worth it -- it's free and requires minimal time to setup and use on an ongoing basis and can provide fantastic benefits that we outlined earlier in this article, so we'd definitely say personal capital is worth using. As for their financial advisement services, we'd say it's worth it for people with high-income jobs and are in a high tax-bracket or people who are new to finance and investing.

Does Personal Capital Work in the UK?

Personal Capital works in the UK, however as they do not have partnerships with most banks or brokerages in the UK it'll effectively be not that useful for tracking your portfolio -- Kubera is a better alternative for tracking your networth and portfolio if you're UK-based.

Is Personal Capital Available in Australia?

Personal Capital works in Australia, however as they do not have partnerships with most banks or brokerages in the Australia it'll effectively be not that useful for tracking your portfolio -- unfortunately we're not too familiar with any Australian companies that offer similar services to Personal Capital at this time.

Is Personal Capital Trustworthy?

Personal Capital is owned by one of the largest asset managers in the world and has partnerships with hundreds of banks and financial institutions -- yes they're trustworthy and safe; the only issue with personal capital is you may be inclined to check your networth obsessively with it being so easily accessible.

Does Personal Capital work in Canada?

Personal Capital works in Canada, however as they do not have partnerships with most banks or brokerages in Canada it'll effectively be not that useful for tracking your portfolio -- WealthSimple or Kubera are significantly better alternative for tracking your networth and portfolio if you're Canada-Based.

Does Personal Capital have a Desktop App?

While most people use personal capital on their mobile phones you can use it on desktop just as easily -- rather than downloading a specific app you can just sign up to personal capital (or login to your existing account) on their website and be able to access all the same features -- for free -- in your web browser.

Our overall Personal Capital rating

3.9

Bottom Line:

Personal Capital is the most powerful free all-in-one finance tracker that allows you to view all aspects of your financial health in one place — including your investment performance, savings rate, networth, and much more.

The only downside to personal Capital is it lacks a few features that some other (non-free) portfolio and financial trackers offer — for example crypto investors would be better off opting for Kubera, as they automatically track cryptocurrency investments, while Personal Capital doesn’t automatically link with cryptocurrency investment accounts — but instead only brokerages, bank accounts, and other traditional investment accounts.

Personal Capital is more than adequate for most people though and generally is a good choice for folks who’ve already got budgeting down and are looking to being working towards being part of the investor class.