Titan Review 2022 - Low-Cost Managed Portfolios

- By Zachary Greene

- |

- Updated on September 18th, 2022

While Titan is often marketed as a hedge fund it’s not exactly a hedge fund — Titan is more of what’s called an asset manager, basically an entity that creates custom portfolios and manages them for their clients — which is much much better than a hedge fund and allows clients and the asset manager not only have more open communication but tailor the investments made more towards the clients goals and individual risk-tolerance.

With that being said Titan isn’t for everyone — as an asset manager they charge fees, and while they’re quite reasonable and less than a hedge fund would charge they are a bit more than ETFs and of course self-constructed portfolios that you manage yourself — which isn’t nessecarily a bad thing.

| 💰 Fees & Pricing | Relatively Pricey |

| 💵 Overall Return | Above-Average |

| 💻 Platform | Simple & Easy to Navigate |

| 🥇 Best For | Growth-Focused Investors |

If you prefer more hands-on investing and choosing individual stocks, selling options against them for income, and generally being very engaged with your investments then Titan isn’t for you — but if you’re just an average person who has a full-time job and little time to bother researching investments and keeping track of what’s happening in the economy and financial world, then Titan is arguably one of the best ways to invest.

Titan is managed by real humans that use data and ai tools to aide them and rather than being a fund that invests in ETFs like most roboadvisors they actually analyse and pick individual stocks and assets they believe will outperform — providing some real value for the fees they charge unlike many roboadvisors on the market today.

With that being said, as Titan is managed by real humans there is a possibility they’ll make mistakes and underperform the market — but as we’ll go over below their current track record is outperformance in general and more than make up for the fees/expenses they charge (covered below).

Table of Contents

Titan Unique Features:

Titan has many unique features that separates it from competitors, but most of them simply revolve around the approach Titan invest takes — having humans analyze the market rather than AI and actually having open dialogue with investors. We’ll touch on these points as well as cover other great features that some other platforms have but most don’t — such as offering retirement accounts.

Low Account Minimums

While most portfolio managers and hedge funds require tens of thousands of dollars to invest with them, often hundreds of thousands of dollars or accredited investor status, however with Titan you can start with as little as $100 — with that being said really it only makes sense to use Titan if you are going to invest at least a few thousand dollars in our opinion, as otherwise the fees would be quite high relative to portfolio size.

Open Dialogue Between You and The Team

While the above might not demonstrate it good it’s hard to put ongoing conversations into a blogpost like this — but essentially Titan uniquely allows average investors to have an open dialogue with the team, get additional information or have questioned answered about the strategy the Titan team is using for the funds, and generally have dialogue between the fund and the investor.

They also have fantastic research reports and justify every investment or trade they make, publishing due-dilligence documents in the titan invest app that allows you to read why they invested in a specific company, what the company is about, and why they picked it rather than competitors for example.

Allows Retirement Accounts

While most traditional brokers like TdAmeritrade offer retirement accounts most mobile investing apps do not — Titan Invest does though, and the only restriction or change compared to their regular accounts is that you cannot currently invest in their cryptocurrency fund. If you want to invest in crypto via a retirement account you’ll have to open an IRA with a specialized company that deals with alternative investments such as AltoIRA or buy a closed-end fund such as one of Grayscales trusts.

Great Liquidity & Redemption Schedule

While basically all other actively managed funds, truly active managed funds and not roboadvisors, charge harsh redemption fees of generally a few percent or require lock-up and redemptions take months…well that’s not the case with Titan.

With Titan Invest you can cash out basically instantly (takes a few days due to bank transfers) anytime you want — and for no fees whatsoever.

Extreme Outperformance (Relative to Competitors)

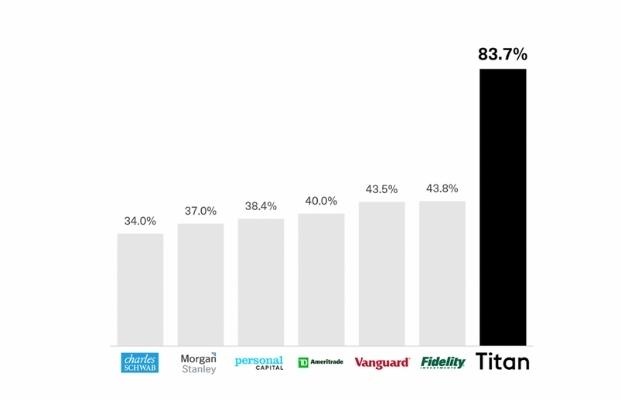

While most asset managers or broker-managed portfolios perform relatively poorly, worse than the market average, historically Titan outperformed the market, or rather the index it’s attempting to track — but with a bit more volatility. This is in contrast to most managed funds by traditional brokers (shown above) which drastically underperform the market on average, usually by a few percent annually.

This of course could change in the future, as Titan’s strategies may have worked great in the last few years but not work at all when market conditions change, such as during a long-lasting recession or depression, but the same can be said for any investment, fund, or ETF — when market conditions change performance will be different than the assets historic performance.

Titan Invest Biggest Pros & Cons:

While we’ve talked quite a bit of Titan’s benefits but we’ve yet to cover their downsides, and we’ve left out quite a few pros so far still — so below we’ll go over those and give you a rough overview if that’s what you’re looking for rather than more in-detailed breakdowns.

With that being said these are the main Pros of Titan Invest:

- Outperforms other managed funds by a large degree

- Allows nearly anyone to invest (only need $100)

- Has a very simple and user-friendly mobile app

- Easily integrates with portfolio trackers like Personal Capital

- Can invest via 401k and IRA accounts without any hassles

- Relatively low-cost compared to competitors

- Offers a Cryptocurrency fund making it a good all-in-one investing platform

- Automatically hedges during market downturns to prevent capital loss

Of course there’s not just pros to Titan Investments, there are some downsides you should be aware of, namely that Titan:

- Does not allow international investors currently

- Doesn’t always disclose trades within the funds immediately

- Doesn’t offer advanced hedge-fund strategies long long-short funds

- Lacks Good Desktop Interface (mobile only)

The downside to this is that while Titan Invests app is fantastic their desktop interface is essentially non-existent, and that’s a real shame — some people prefer checking their investments on their computers and not having such distractions on their phones.

Titan's Pricing, Fees, and Expense Ratio:

Titan has a dual pricing scheme where they charge either $5 a month or 1% per year depending on your portfolio sizing — if you have less than $10,000 invested with Titan you pay a flat $5 per month and if you have more than that you pay 1% of your portfolio per year in management fees.

The flat-rate $5 per month comes out to less than 1% per year if you have close to $10,000 invested, or a bit more if you have less than $5,000 invested — so overall having a small starting portfolio isn’t a reason not to go with Titan, at least if you have a few thousand dollars to begin investing with.

Comparing this to other funds and asset managers the 1% fee is fantastic — most charge 2% to 3% + a share of the profits (usually 20%), so Titan’s fees are much less than other actively managed funds, asset managers, and hedge fund type entities. Of course it’s a bit higher than ETFs that aren’t actively managed though, but ultimately fees shouldn’t matter — what matters is the overall net return after fees, and as you’ll see below Titan has a good track record and has outperformed.

Titan Invest Historic & Expected Returns:

Titan has many fund offerings all with very different investment returns overall — we’ll go them over below individually first and the details about each fund, their historic returns, what they typically hold, and other elements we think are important to know about before investing in the funds.

You can invest in any of these funds in particular on their own, or create a portfolio of these funds like Titan recommends — we’ll touch more on this in our conclusion, as well as share our preferred allocation.

Titan’s Flagship Fund Review:

This is the primary fund most people invest in, and invest the most in, when investing with Titan and it’s attempting one of the hardest feats — beating the S&P 500 — and succeeding quite well at it I’d argue. You may say wait a minute — but they’ve underperformed the S&P 500 since inception!

You wouldn’t be wrong in such a statement — as since inception they have, as in the rough market of early 2022 they were heavily invested in tech stocks like google, which took a beating more than consumer-goods stocks like Kimberly Clark did — however historically, until this correction in particular, they’ve successfully outperformed the S&P to a large degree, both in downturns and in recoveries.

Because of this while some may say the fund is not a good investment I’d argue it is — we’ve been experiencing extraordinary market conditions in early 2022, we’ve had a crises happen in Eastern Europe, we’ve had extreme inflation of consumer goods, we’ve had travel restrictions, we’ve had aggressive FED/Monetary policy. Overall from here, as Titan’s Flagship Fund does well in recoveries, I’d rather own it than the S&P 500.

What are the holdings of Titan’s Flagship Fund?

This isn’t 100% clear as they do not release the holdings the moment they make a trade or investment — instead like all funds they only disclose them publicly, in their entirety, once a quarter in their 13F filing with the SEC. This is to protect investors in the fund(s) from being frontrunned, copied, or attacked, and to ensure the fund can operate as intended without interference from 3rd parties.

Having said that generally the flagship fund holds similar top 10 holdings to the S&P 500, combined with a handful of other companies they believe will outperform — all US based and focused companies, and not always tech companies (other than the top 10).

Titan Opportunities Fund Review:

Titan’s Opportunities fund has outperformed the index (Russel 2000) by around 4% to 4.5% annually, with periods of extreme outperformance — however I’d like to stress that the fund has a short track record of only a couple years so this outperformance might not last.

With that being said from the looks of it Titan has done well beating the Russel 2000 — and is a great way to gain exposure to smaller US-based companies.

What are Titan’s Opportunities Fund Holdings?

They do not publicly list their holdings accurately to the day so we cannot say for sure — however you can check the in-app documentation and their 13F filings to peak in and see what the fund held at the end of every quarter. From previous 13F filings it seems like they’ll buy into any company in any field if they think it’s undervalued, although seem to prefer more consumer-goods companies than tech or software companies.

Titans Offshore Fund Review:

The picture here isn’t pretty — not only did Titan underperform the index/benchmark, but they did so massively coming in down over 20% more than the index. If you invested in this fund in 2021 you were absolutely slaughtered, losing 30%+ of your invested assets in one short year.

With that being said emerging markets have been rough the last few years and the reason Titan underperformed so massively relative to the benchmark is because they aren’t diversified into all the commodity companies in the international market that did well — but rather focus on growth, which means mostly tech and ecommerce investments.

While such a strategy normally has been highly successful Titan’s offshore fund seems to have launched at the peak of the market right before currency-issues and geopolitical issues began destroying international stocks, especially international tech stocks due to their predominantly China-based nature. This is why the fund performed so badly so far — it’s not to say Titan invested in bad companies, just that they focused on growth companies and likely had too much China exposure.

What are the Titan Offshore Fund Holdings?

Unfortunately just like with all of Titan’s funds there are no public holdings available — you’ll have to check their 13F filings or documents in-app to figure out where their current holdings are — which aren’t updated immediately, but often take a few weeks or months to be updated. This is to prevent counterparties/other-hedge funds from disrupting or front-running their investing decisions to purchase or sell a company.

Titan’s Cryptocurrency Fund Review:

Above you can see Titan’s Cryptocurrency fund’s performance relative to the baseline (Bitwise’s Large Cap Index) which is meant to represent the top cryptocurrency projects that are established and highly valued and respected — as you can see the dark blue line (Titan) outperformed the index slightly since inception.

With that being said, due to the declines in cryptocurrency market in early-mid 2022 both funds experienced declines that lead them to having an overall negative return — Titan’s fund at the time of writing is at -8% since inception while the index is at -14% which is quite a bit more than Titan’s losses — so we’d say Titan did a good job with their cryptocurrency fund.

Sure the fund wasn’t up to this point — but it’s served it’s purpose — to give exposure to the crypto market if you wanted it, and hedged the downside risk, saving investors 6% in less than a year relative to the index’s performance.

What are Titan’s Crypto Funds Holdings?

Titan doesn’t publicly release it’s holdings beyond their legal requirements to do so — so we can’t really tell you their holdings 100% accurately.

With that being said when titan released the fund they had around half the fund in Ethereum and a little less than half in bitcoin, and the rest in a Cardano. Since then it appears they’ve expanded their Altcoin investments, but only to quality coins like Chainlink, Polkodot, etc, and they still invest the vast majority into Ethereum and Bitcoin.

Keep in mind the fund is meant to more or less track the index, but outperform it — that means they’ll generally invest similar to the fund, but with slight differences that they hope makes them outperform the index over time.

Titan Invest vs Competitors:

While it’s a bit hard to compare Titan to competitors as they have many funds while most competitors are just general roboadvisors, we’ll try our best — to make it fair we’ll use Titan Invest’s Flagship fund as the benchmark to compare the competitors performance to as most competitors goal is also to beat the S&P 500, just like Titan’s goal with the Flagship Fund — we’ll also note their fees and other features, but ultimately what matters most is overall return in our opinion.

Titan Invest vs Wealthfront

Wealth front is a full-fledged roboadvisor while Titan Invest is an asset manager that has humans rebalance and adjust your portfolio of investments depending on market conditions — while wealthfront charges a lower fee of 0.25% vs Titan’s 1% fee the overall return of Titan’s Flagship fund has been 10.9% annually at the time of writing while wealth front has returned (at most) 6.94% anually or 7.94% annually during the same time period as Titan Invest’s fund has been available.

Due to Titan’s historic return being around 3% to 4% higher per year compared to Wealthfront we’d say without a doubt Titan is better than wealth front — at least if you don’t mind a bit extra volatility, as portfolio swings with Titan are a bit more extreme during dips than Wealthfront.

Titan Invest vs Acorns

Acorns charges high fees relative to Titan and more or less takes the funds they recieve and invests them in the S&P 500 — so the return compared to Titan Invest’s Flagship fund is more or less identical, with Titan winning out during bullish markets and recoveries and Acorns winning out during flat periods or bearish periods by a small margin (historically, may change in the future).

Overall they’re very different services and if you want to invest you’re likely better off with a proper investing app like Titan or M1 Finance, while if you want to have a banking/saving account Acorns is clearly the better choice for that as that’s not what investing apps are for.

Titan Invest vs Robinhood

Robinhood doesn’t really offer portfolio management or roboadvising so we’d say they’re not really comparable platforms — Robinhood you can buy and pick individual stocks, or opt for index funds, and pay no management fee, while with Titan Invest everything is managed for you. Robinhood is likely better if you want to self-manage your investments and like investing/finance as a hobby, while Titan is likely better if you just want to grow your wealth hands-off and aren’t really passionate about finance/investing.

Titan Invest vs Vanguard

Vanguard offers a portfolio management service like Titan, but also offers self-directed ETF portfolios — the self-directed portfolios obviously depend on what you choose to invest in so we can’t really compare them to Titan — but the managed portfolios Vanguard offers we can.

In the same time Vanguard’s managed fund returned 43.5% titan returned 83.7% as shown in a figure above (in the features section of the article), and that’s really all that needs to be said on this issue in our opinion — if you want portfolio management Titan does a much better job than Vanguard.

Closing Thoughts & Conclusions:

There’s not much more to say — but to conclude we’d say Titan is a fantastic choice if you have a ‘real job’ and aren’t extremely passionate about finance/investing and treat it as your #1 hobby. They manage portfolios and most funds generally outperform the index’s/benchmarks they attempt to beat, making them an overall better option than ETFs in our opinion, at least if you don’t mind some extra volatility (swings in your portfolio) along the journey to becoming wealthy.

One thing we haven’t touched on yet is what fund we think is best — and if we’re being honest we’d say the Cryptocurrency fund is our #1 pick and the opportunities (small-cap) fund is our #2 pick of the Titan funds — however Titan recommends investing in a diversified portfolio of their funds (shown below) so you may want to consider following their suggestion, especially if you aren’t used to high levels of volatility.

Those are the allocations Titan recommends if you are trying to invest for the long-term with them — in case you’re on mobile and can’t read the screenshot to be clear Titan Invest recommends:

- Aggressive Long-Term Investors to put 60% in their Flagship Fund, 17.5% in the Opportunities Fund, 17.5% in their Offshore Fund, and 5% in their Crypto Fund

- Moderately Aggressive Investors to put 70% in the Flagship Fund, 13.5% in both the Opportunities and Offshore fund, and 3% in the Crypto Fund

- Moderately Conservative Investors to put 80% in the Flagship Fund, 9.5% in both the Opportunities and Offshore Fund, and only 1% in the Crypto Fund

Titan Invest Review FAQ's:

Below we’ll go over the FAQ’s we’ve been asked, or encountered, or even had asked ourselves about Titan Invest when we first started checking them out and as we used them — If you have other questions feel free to contact us and we’ll get back to you as soon as we can — and likely even add our answer down below.

Is Titan a Good Investment?

Using Titan Invest in our experience has been a good investment for us as it’s returned quite well over the last few years — better than the broader market has historically, and overall we’re satisfied with our investment in the sector through Titan Investments. It’s not our highest returning investment, but it’s a nice investment that returned above average returned and helped diversify our portfolios away from more risky volatile investments.

How long has Titan Invest been around?

Titan Invest in it's current form started accepting clients in 2018 after opening it's flagship fund to the public however didn’t real gain substantial traction until 2020-2021 — currently they have a bit over 200 employees and partners, although not all of them are full-time from our understanding.

Does Titan Invest offer any sign-up bonuses or rewards?

As far as we’re aware of Titan does not offer any sign-up bonuses or rewards for new users — they do however have a partner program that allows websites like this one to earn a small savings on platform fees or in some cases compensation if people sign up through their special partner links. You can use ours by clicking here, doing so will support us and help us keep these articles up to date and accurate.

Does Titan Provide Insurance?

Titan provides insurance through the SIPC insurance scheme which gaurantees investors investments and cash holdings in investment accounts like Titan Invest -- they cover up to $500,000 including up to a maximum of $250,000 held in the account in the case of insolvency or other issues with Titan Invest.

Is Titan Invest (the company) Publicly Traded?

Currently Titanvest is not publicly traded and instead is entirely funded through private funding rounds and founder/employee contributions. They’ve completed a series A funding round via crunchbase, however are likely years away from going public or being acquired by a larger firm.

Is Titan Invest Safe to Use?

While investments with Titan can of course go down you're always notified of changes to how they're investing and their plans, outlook, and current market conditions, so if you disagree with what they're doing you can always liquidate your investment immediately. Titan invest is also insured in the event of bankruptcy or other issues, so this should not be a concern.

Titan Invest is also a well-established well-funded company with hundreds of employees and isn't a scam or anything like that -- they're just as trustworthy as any big broker in our opinion.

Our overall Titan Invest rating

4.3

Bottom Line:

Titan Invest is a good choice for growth-oriented investors looking for a managed portfolio that generally outperforms other managed portfolios.

If someone is very busy and isn’t interested in learning about investing, and doesn’t want to just buy the broad market (S&P 500), then Titan is arguably the best platform/fund-manager to go with as their fees are relatively low and they generally outperform other managers, especially robo-advisors.